유례없는 iPhone15 Pro 시리즈 스팩

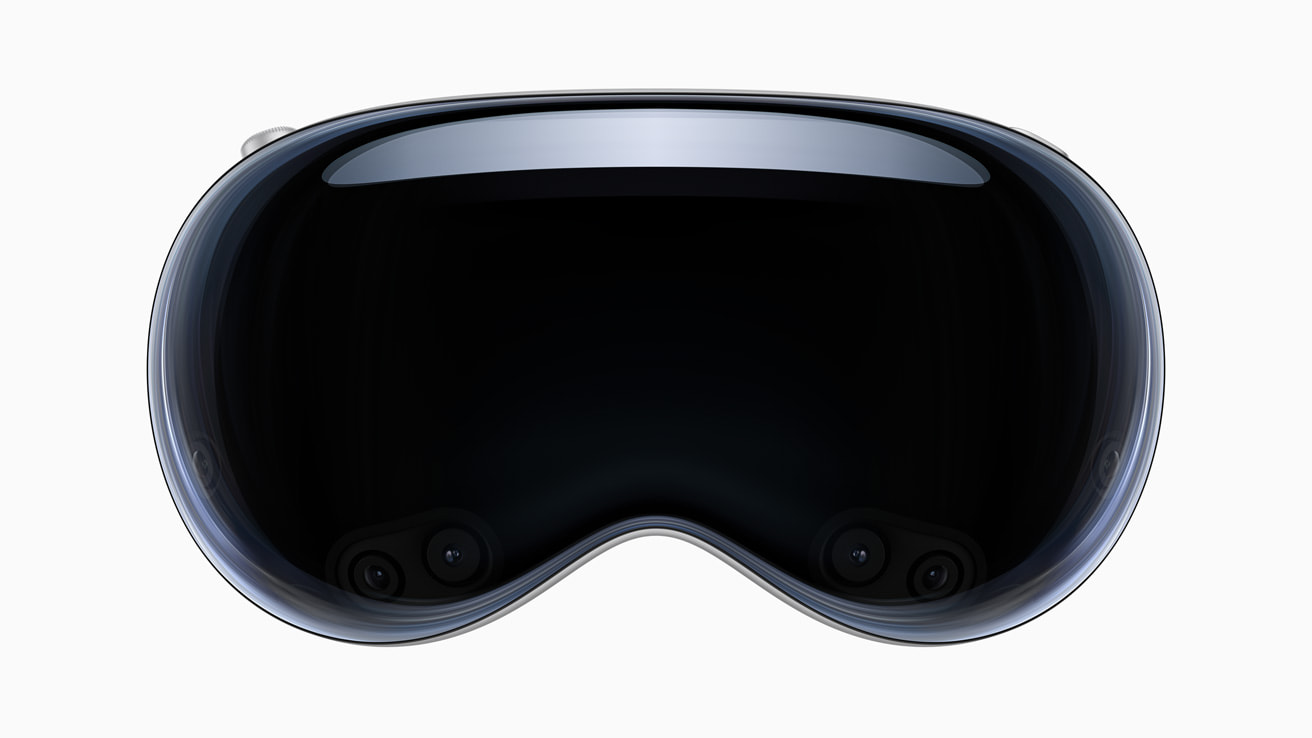

아이폰15 프로 시리즈 2023년 아이폰15 프로의 새로운 런칭 행사가 열렸습니다. 한국 시각 9월 13일 새벽, 현지 시각, 9월 12일 애플은 미국 쿠퍼티노에서 ‘apple 이벤트 2023’을 진행했습니다. 이번 행사에서 애플은 스마트폰과 스마트 시계의 비젼과 친환경 정책을 발표하였습니다. Apple의 또 다른 진보가 시작 된 것입니다. iPhone15에 이어, 아이폰15 Pro와 iPhone15 Pro Max가...